-

A team of professionals is ready to help you reach your financial goals.

Call us today for aFree Consultation -

-

-

Monitoring your credit can help you detect possible identity fraud and also help you identify credit report errors and inaccuracies. Plus, your credit scores indicate your credit-worthiness with lenders, employers, and rental management companies. Which is why it's very important and recommended to constantly view your credit report and monitor the following:

79% of all credit reports contain errors and inaccuracies & identity theft continues to grow.

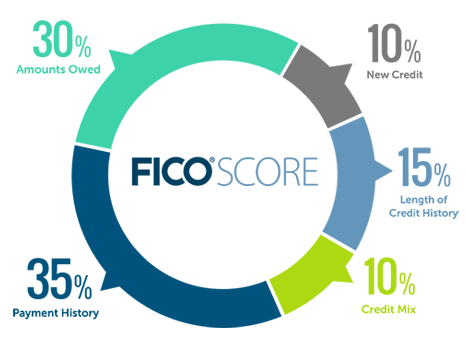

Payment History (35%)

As you can see from the FICO Score pie chart above, the largest factor affecting your credit score is your payment history. This includes your track record for making regular and timely payments on all open accounts being reported to the credit bureaus. The later you are on making your payments (30 days, 90 days, 120 days, etc.) the more negatively that account will affect your credit score.

How Much You Owe (30%)

The next biggest factor affecting your FICO score is how much you owe on each of your individual accounts. The most important aspect of how much you owe "current balance" is in relation to what your installment loans' original balances were and you revolving's existing credit limit.

Length Of Credit History (15%)

The third component of your credit score relates to how long it has been since you first applied for credit. Another factor is how long you’ve held specific types of accounts. The longer and installment or revolving account has been opened, the better for your credit scores.

New Credit History (10%)

Another component of your credit score is how much new credit you've applied for and/or received in the recent past 12 months. In general, the more time that has passed since any previous credit inquiries, the higher your credit scores.

Types Of Credit Used (10%)

The final component affecting your credit score is the different types of credit accounts you have in your credit file. The more diversified portfolio of credit accounts in your credit report (installment and revolving accounts), will result in a higher credit scores.

In today’s world, everything revolves around credit and being prepared with your credit can be the difference between being approved or declined on your next purchase.

Being on top of your credit can lead to many benefits, such as:

Not to mention the credit monitoring features…

$1.00 for 7 Day Trial

& $29.86 per month Sign UpA great plan to get started.

Standard rate: $1 for 7 day trial

& $31.49 per month.

Save $1.63 monthly (5% discount)

Cancel at any time.

$23.86 Enrollment

& $23.86 per month Sign UpExclusive Easy Solutions Credit offer.

Standard rate: $29.99 enrollment

& $29.99 per month.

Save $6.13 monthly (25.7% discount)

Cancel at any time.

Choose the best solution for your credit needs.