-

A team of professionals is ready to help you reach your financial goals.

Call us today for aFree Consultation -

-

-

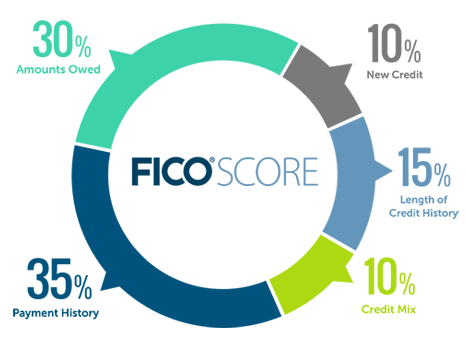

Payment History (35%)

As you can see from the FICO Score pie chart above, the largest factor affecting your credit score is your payment history. This includes your track record for making regular and timely payments on all open accounts being reported to the credit bureaus. The later you are on making your payments (30 days, 90 days, 120 days, etc.) the more negatively that account will affect your credit score.

How Much You Owe (30%)

The next biggest factor affecting your FICO score is how much you owe on each of your individual accounts. The most important aspect of how much you owe "current balance" is in relation to what your installment loans' original balances were and you revolving's existing credit limit.

Length Of Credit History (15%)

The third component of your credit score relates to how long it has been since you first applied for credit. Another factor is how long you’ve held specific types of accounts. The longer and installment or revolving account has been opened, the better for your credit scores.

New Credit History (10%)

Another component of your credit score is how much new credit you've applied for and/or received in the recent past 12 months. In general, the more time that has passed since any previous credit inquiries, the higher your credit scores.

Types Of Credit Used (10%)

The final component affecting your credit score is the different types of credit accounts you have in your credit file. The more diversified portfolio of credit accounts in your credit report (installment and revolving accounts), will result in a higher credit scores.

Bad credit score costs money, but the public is probably not aware of how much that can add up to over time. In many cases it could be over $1 million, that’s right over seven figures!

If you have bad credit, the additional money you pay for things like mortgages, car loans and insurance, compared with what others with good credit pay, can be six figures over a 30-year period. Now if that money is invested wisely that number could rise to more than $1 million.

Here is how bad credit costs you client in more ways than you imagined:

Mortgage:

One obvious place that bad credit hurts you is the interest rate you must pay when you purchase a house. The Average price for a home in June 2007 was $316,200. A 30-year, $300,000 loan for someone with a credit score of between 760 and 850 carried a 6.346% APR. Someone with a credit score of between 500 and 579 would have a 10.152% APR. That would mean that a person with a good score would have a monthly payment of $1,866, while the person with the bad credit score would pay $2,666 – or $800 a month more for the same house. That adds up to 288,000 over the 30 years of the loan.

Auto loan:

Edmunds.com says that the average car loan is $24,864. Just think, an auto loan for a person with good credit (defined as a score of between 720 and 850) would carry a 7.221% APR, while someone with bad credit (a score between 500 and 589) would have to pay a 14.909% APR That works out to a difference of $88 a month, which comes to $3,168 over the three years of the loan. The average person keeps their car for 4.5 years.

That means if each person financed a new car every five years, it would cost the person with bad credit $19,008 more in car financing over 30 years than someone with good credit.

Credit cards:

Let’s assume, for our example, that both the people with good and bad credit both carry the median credit card debt of $2,200 over 30 years. If the person with good credit had an interest rate of 9% and the person with bad credit had an interest rate of 20%, the person with bad credit will pay an extra $7, 260 over a 30-year period.

Insurance:

All types of insurance (auto, health, homeowners) will likely cost more for a person with bad credit than one with good credit. Insurance companies know that people with bad credit make more claims than those with good credit – and therefore are more of a risk to insure.

If your credit score is taken into account on any of your insurance rates, an individual with bad credit will pay more than a comparable individual with good credit.

Job:

You may lose out on a better job due to bad credit. More and more employers pull your credit report when you apply for a job, because many see a risk in employing a person with bad credit. The same can be true with promotions. For example, people in the armed forces may not be able to get clearance for classified documents and areas due to bad credit, therefore blocking potential advancement.

Housing:

Many apartment managers will run a credit check on prospective tenants. If your credit is poor, you may be denied a unit due to the risk that you may not be able to pay.

Deposits:

If you have bad credit, you may need to leave a deposit — or a larger deposit — with certain companies than you would if you had good credit. Utility and cellular phone companies sometimes ask for deposits with people that have less-than-stellar credit

Health:

In addition to all the financial aspects where bad credit will hurt you, it could also adversely affect your health. It’s not difficult to imagine that a person who has to pay a couple of hundred thousand dollars more for the same house as a neighbor down the street could have some financial stress in their life. This stress can affect a person both mentally and physically, if the bad credit is constantly a source of fighting in the house

Bad credit is no longer a situation that can be isolated from other areas of your life. The trend is only growing stronger. Consumers must take the time to make the effort to keep their credit in good standing. It will pay off with more money in your pocket and less stress in your life.

Your credit report is a record of how you’ve paid your bills in the past. Basically there are two types of credit reports: those provided to businesses and those provided to consumers. The credit reports have essentially the same type of information, though it is presented in different formats for each use.

Credit bureaus or credit-reporting agencies — these terms are interchangeable — are the companies that compile credit reports. There are three major, national credit reporting agencies in the United States: Experian (formerly TRW), Equifax and TransUnion, plus hundreds of smaller credit bureaus that are affiliated with one or more of the Big Three. These specialized agencies get information from one or more of the three major bureaus and may supply additional credit information as well. If you have ever applied for housing rentals, mortgage or auto financing, employment, insurance, or any almost any type of credit, you have a credit report in your name (also called a credit file or credit history) at one or more of these credit bureaus.

Creditors (banks, credit card companies, finance companies etc.) supply credit bureaus with information they receive from applications and existing accounts. Creditors work with different credit reporting agencies, or may use a combination of credit reporting agencies. Every creditor does not report to all of the credit bureaus. It’s the creditor’s choice who they provide your information to.

Remember this important fact: Credit bureaus are independent entities that compete against each other for business. They do not share information with each other. And again, not all creditors report to all three major credit bureaus. If you have seen your credit report from these different companies you will notice that the information in each file may not be exactly the same. This is due to the fact that all your creditors may not work with each credit reporting agency, as well as the fact that each credit reporting agency may have slightly different reporting formats.

Here’s how information from your applications makes it to a credit reporting agency: You submit your application for credit, housing, employment or insurance to a company. That company uses the personal information from your application to order a single or a combination of credit reports from one or more of the major credit bureaus. What happens next is mostly automated. If the information you provided matches information that is currently in a credit reporting agency’s databanks, a report is generated. If there is no match, a blank credit report is generated. In the meantime, identifying information about you: name, address and social security number, for example, is going to be retained by the credit reporting agency. Once you do have an account with a lender, in most cases, it will be reported monthly, and sometimes every other month.

The contact information for the three agencies below is only for ordering your credit report. If you need to talk to a representative about a specific account listed on your report, use the contact information specifically for issues and questions.

www.equifax.com/

Phone866-349-5191

MailEquifax Information Services LLC

P.O. Box 740241

Atlanta, GA 30374-0241

www.experian.com

Phone877-322-8228

MailExperian National Consumer Assistance Center

PO BOX 2104

Allen TX 75013-2104

www.transunion.com

Phone800-888-4213 (Automated System)

MailTrans Union Consumer Relations

PO BOX 1000

2 Baldwin Place

Chester PA 19022